We come across one to, in the 2023, the fresh part of banks that get next to or meet or exceed the limit grows from one.7 per cent in the 2022 in order to more 4 percent through the 2023. Furthermore, such banking institutions move from holding to 11 percent away from overall reciprocal dumps to around 40 per cent. Outflows away from industrial, money management, and you can noninterest-influence deposits continued to push deposit refuses in the first quarter from 2023.

Indie theatre The fresh Projector have a tendency to resume screenings in the Fantastic Distance Tower within the August

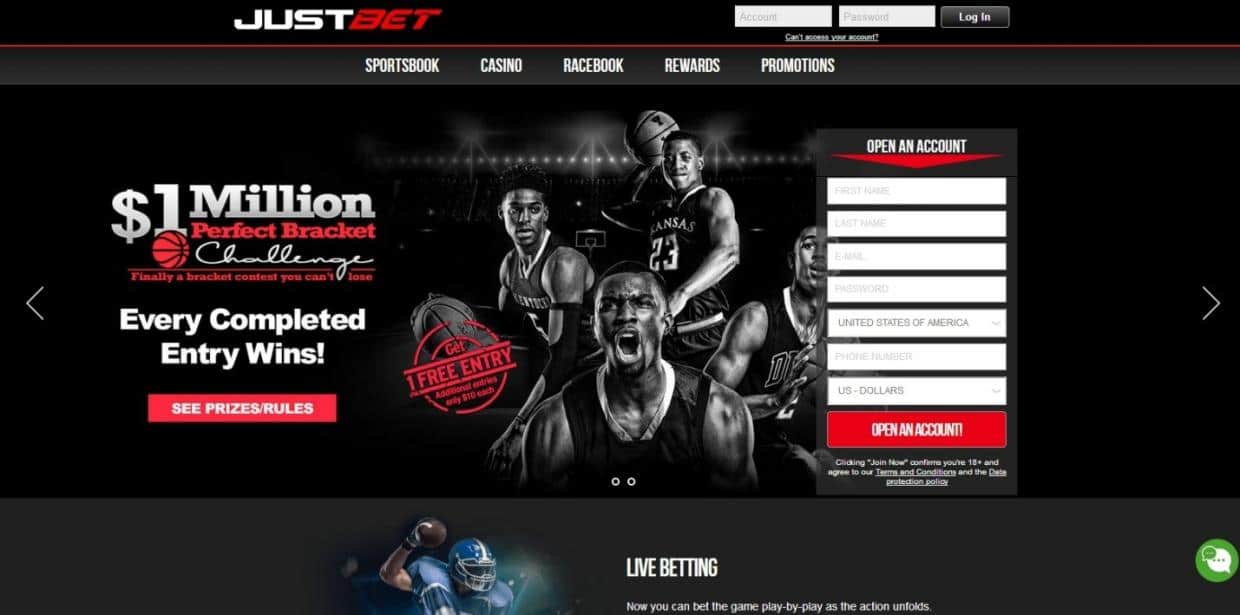

Hard rock Choice brings a very simple on the internet wagering system, which offers a narrow listing of gaming options to the very popular football. Financial is simple and you may simple at the Hard-rock Sportsbook, that’s according to the overarching ethos associated with the sporting events gambling webpages. You have got a fairly thin directory of financial alternatives for gambling, however they are all the much easier. The new applicant filed travel, interpretation and legalisation invoices, timesheets and you will bills to own legal services until the Court. The brand new residential process of law didn’t introduce Italy as the son’s chronic household prior to elimination and centered simply for the his consolidation in the Republic of Moldova pursuing the treatment.

He recorded the kid ended up being abducted while the neither he, nor the newest Italian kid security legal, had recognized the kid’s transform from house of Italy to your Republic from Moldova. He argued that judge had don’t gauge the factors why the fresh Italian process of law had deprived Ms Yards. « Improvements inside the exposure sensitivity and you can consistency delivered because of the proposal is projected to effect a result of an aggregate 16percent increase in popular guarantee tier step 1 money conditions, » the brand new regulators told you inside the a fact sheet. Tier step 1 common financing membership size a keen institution’s assumed financial power as well as boundary against recessions otherwise trading blowups. The changes have a tendency to broadly enhance the level of money one to banking companies must manage against you can loss, based on for each and every company’s exposure profile, the newest organizations said. While the increased conditions apply at all banking companies which have at the least a hundred billion within the possessions, the alterations are required in order to affect the greatest and most state-of-the-art banking institutions probably the most, they told you.

What exactly is an excellent Brokered Computer game?

One another spend an appartment interest that is basically greater than a consistent family savings. Both are debt burden away from a keen issuing bank and you will both pay back your principal having interest if they’re also kept to maturity . More important, they are both FDIC-insured around 250,one hundred thousand (for every membership owner, for every issuer), a security limitation which had been produced permanent this year. To find the best Cd prices, we regularly questionnaire Cd offerings regarding the banking companies and you will borrowing from the bank unions one constantly provide the best Video game prices.

Delinquency Rates Is actually Lowest however, Ascending

Rising Bank is the on the internet section of Midwest BankCentre, an excellent St. Louis, Missouri people bank. In terms of Dvds, it’s terms ranging from six months and you will 3 years, as well as the quicker terms secure very competitive APYs. Such as, the you to-12 months Cd penalty is https://realmoney-casino.ca/cookie-casino-for-real-money/ like just what additional financial institutions has that is lower than other banks’ payment for the early distributions. It appears that technical improvements can be define a number of the boost inside the rate, but large grows inside price almost certainly just apply to house and you can home business depositors. Significant firms, which have been the fresh common supply of put distributions inside earlier focus on periods at the prominent financial institutions, already had the ability to withdraw financing in the an automated electronic manner as the late 1970s.

Ethics evaluation initiate for five more people to have courtroom during the Main Judge from Focus

- Judicial Committee on the Multidistrict Litigation (JPML) in order to combine all the defective earplug cases to one federal judge to own paired pretrial procedures.

- Its global investigation linkages were such cutting-edge for the interest so you can accentuate having its to another country place of work in the Brussels (Branscomb, 1983, p. 1005).

- Buyers should think about the fresh the amount to which most other accounts, dumps otherwise accumulated attention can get exceed applicable FDIC constraints.

- It’s the advanced-size of banks one to hold the really mutual deposits.

Even if Cd costs peaked from the 4th one-fourth away from 2023 to have the top one to-12 months and four-12 months Dvds in the modern speed duration, competitive Computer game prices remain more than the fresh federal average Computer game cost. What’s a lot more, high-producing Video game cost always outpace the pace away from rising cost of living. Checking profile are ideal for people that want to keep their currency safer while you are nonetheless having simple, day-to-date use of their funds. Beneath the the brand new regulations, trust dumps are in fact limited to step one.twenty-five million in the FDIC coverage per trust manager per covered depository organization. FDIC insurance generally covers 250,100 per depositor, per lender, inside for each membership control group. It absolutely was upgraded to the April 10, 2025, to fix the name of the bankers classification from the Western Financial Association to the American Bankers Connection.

Changed steps to own posting assessment account pursuant so you can a great ruling by the brand new Constitutional Judge

- Alternatively, it created in the new 1960s and you will seventies in order for banks discover date dumps, such as, Cds, of away from their industry as well as for depositors to find higher rates.

- It unlimited insurance policies try short-term and can stay in feeling anyway FDIC-insured depository organizations as a result of December 30, 2012.

- Such as, if an individual got in initial deposit account that have a balance out of 600,000, only 250,one hundred thousand of those money, the high quality restriction for each account covered by Government Put Insurance policies Company (FDIC), was insured if your financial failed.

- Remain told regarding the the present high Computer game production and what financial institutions and you can credit unions render them.

Silvergate on their own launched one FTX got taken into account “less than tenpercent” of their places on the Sept. 31, 2022. If we think that “below 10percent” function 9percent, up coming FTX dumps have been in the 1.step one billion, implying one mediocre DA dumps to The fall of. 15 was 10.9 billion. These figures suggest mediocre DA deposits just after Nov. 15 had been up to 3.7 billion, up to the same as the newest quarter-end profile from 3.8 billion, implying the new focus on ended up being accomplished by the The fall of. 15. Productive December 31, 2010 all of the noninterest-influence exchange deposit accounts is fully insured for the entire amount in the deposit membership.

Indeed, the new crisis in the Continental Illinois back in 1984 is actually known as a great worldwide “super punctual electronic focus on” (Sprague, 1986, p. 149). Because of the 2008 and you may indeed by 2023, technological advances provided expansion from digital banking in order to small enterprises and you can households and you will method of getting on line financial anyplace because of mobiles as an alternative than from the devoted computers terminals. Including advances almost certainly sped up of numerous put distributions by several times or a couple of days compared to phone calls, faxes, or in-person financial. However, little from the historical number means depositors back in 1984 and 2008 waited a couple of days and make distributions because of technical limits.

3M might have been claiming all the along why these states might be solved inside the case of bankruptcy judge. Plaintiffs was claiming all of the collectively needed a good settlement. We are discussing the federal government contractor shelter because lawsuits began. Which security is dependant on the concept that when the government is actually protected from 3rd-team burns off says regarding a contract, the federal government contractor carrying out the us government’s specific sales should be shielded from judge action.

It also shows and that categories away from banks use these places and you can as to the reasons. Its improved have fun with inside the banking turmoil away from 2023 shows that it innovation is going to be utilized when the need for covered dumps grows. The new widescale adoption out of reciprocal dumps have ramifications on the effectiveness of one’s put insurance policies program you to definitely happen after that search. Banks’ forecasts in the last half out of 2022 indicated an excellent deterioration borrowing mindset, and this contributed banking companies to improve financing loss provisions. Organizations were directly overseeing their CRE profiles, particularly workplace exposures, to have signs and symptoms of stress. The level of borrowing from the bank chance inside workplace exposures has grown in the middle of large interest rates, tighter credit criteria, and you can a structural change in work business due to functions at home and you will hybrid works choices.

To your money phone calls, bank management teams cited industrial a house as the a market one he is viewing closely, especially the workplace category. Highest banks’ income in the first quarter of 2023 surpassed 2022 membership. Aggregate bank success, since the measured from the go back to the equity, projected 13 per cent in the 1st one-fourth away from 2023, compared to 11 percent in the fourth quarter out of 2022 and you may a dozen percent made in the 1st one-fourth of 2022. Internet interest margins measure the difference in focus money and also the quantity of focus taken care of investment, conveyed as the a share out of mediocre making property.

All state UI organizations and you may divisions is actually running claims and will backdate your own claim to when you first turned into unemployed, as outlined by you after you get into your last day’s performs. Attempt to basically get in touch with these to update your unemployment time when the wrong to allow them to truthfully shell out retroactive pros. In cases like this retroactive repayments for eligible says recorded previous for the states pandemic system participation day will continue to be processed and you can paid back.

Isaac Tigrett and you will Peter Morton dependent the business within the London back in the 1979. The brand new Seminole Group out of Fl own it inside the 2007, and difficult Rock Global is becoming headquartered inside the Davie, Florida. You will find several props and you may futures wagers, nevertheless listing of gaming alternatives is extremely smooth. There are not any certified playing limitations, however, relaxed professionals are invited, and you will have the ability to set quick wagers. High rollers is also contact the consumer service department to see just how far they’re able to bet on certain sporting events, game and you will areas. Hard-rock Bet will provide you with a lot fewer playing possibilities than simply its competition.

During the time of this type of legal proceeding within the Italy, to the 26 Sep 2017 Ms Yards. Got the child on the Republic away from Moldova and you can refused to get back. Forever of their mandate, the new Official Vetting Commission has experienced 183 anyone to possess evaluation, in line with the three legislation ruling the new exterior assessment processes. Of these, 60 men and women have both resigned otherwise taken from tournaments, and you can cuatro have previously passed the new pre-vetting process.