In the world of online trading, regulation plays a crucial role in determining the legitimacy and safety of trading platforms. One such platform that has gained popularity among traders is is pocket option regulated in the us Pocket Option. As with any trading platform, potential users often wonder: is Pocket Option regulated? In this article, we will delve into the details of Pocket Option’s regulatory status, the importance of regulation in trading, and what this means for your investment safety.

Understanding Regulation in Online Trading

Regulation in the financial industry implies that a trading platform adheres to specific legal standards set by government entities or independent organizations. These regulations are intended to protect investors, ensure fair trading practices, and promote transparency within the financial markets. Without proper regulation, a trading platform may engage in unethical practices, leading to significant risks for traders.

A Brief Overview of Pocket Option

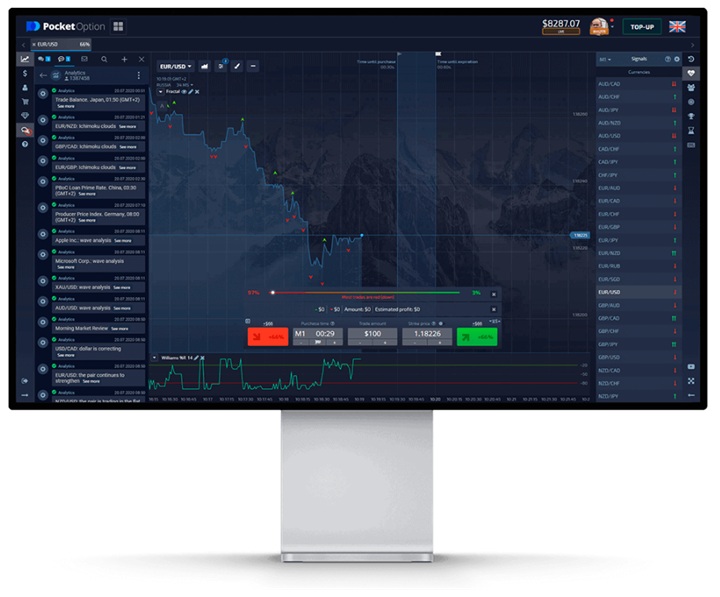

Pocket Option is a binary options trading platform established in 2017. It offers traders access to various financial instruments, including currency pairs, commodities, and cryptocurrencies. With an intuitive user interface and various trading tools, Pocket Option has attracted a significant number of users worldwide. However, the question of regulation remains crucial for potential traders considering the platform.

Is Pocket Option Regulated?

Pocket Option is not regulated by any major financial authority like the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the United States. Instead, it operates with a license from the International Financial Market Relations Regulation Center (IFMRRC). However, this regulator is not widely recognized and does not carry the same weight as those mentioned earlier. Therefore, while Pocket Option may have some level of oversight, it does not provide the robust consumer protection that comes with regulation from more authoritative bodies.

The Implications of Being Unregulated

Trading with an unregulated platform can present several risks. Firstly, there may be minimal recourse for traders in the event of a dispute. In regulated environments, traders have access to legal channels and organizations that can assist in resolving issues and disputes. Secondly, the lack of regulation may increase the risk of platform insolvency and reduce the safety of your funds. Regulated brokers usually maintain segregated accounts, ensuring that client funds are protected even in adverse situations.

Safety Measures at Pocket Option

Despite the lack of robust regulation, Pocket Option has implemented various security measures to protect user information and funds. The platform utilizes SSL (Secure Socket Layer) technology, which encrypts data exchanged between a user’s browser and the platform, safeguarding user data from unauthorized access. Additionally, Pocket Option has integrated two-factor authentication (2FA) to further enhance account security.

Customer Reviews and Feedback

One way to gauge the reliability of a trading platform is to examine user reviews. Unfortunately, feedback regarding Pocket Option is mixed. Some users praise its user-friendly interface, quick withdrawal processes, and various trading options. However, others express concerns over customer support and the platform’s handling of disputes. Such mixed feedback should be taken into account when considering whether to use the platform.

Final Thoughts

In conclusion, the question of whether Pocket Option is regulated is complex. While it does operate under the oversight of the IFMRRC, it lacks the regulation of more recognized bodies such as the FCA or CFTC. Traders should carefully weigh the risks associated with trading on an unregulated platform against the potential rewards. Before investing your hard-earned money, it’s critical to conduct thorough research, considering factors such as regulatory status, security measures, and user feedback.

Ultimately, if you choose to trade on Pocket Option or any other unregulated platform, make sure to practice responsible trading habits and only invest what you can afford to lose. By staying informed and vigilant, you’ll be in a better position to navigate the online trading landscape safely.