In the world of investing, two of the most popular options are trading forex vs stocks Trading PH in foreign exchange (Forex) and trading in stocks. Each has its own unique characteristics, risks, and rewards. This article will delve into the various aspects of trading Forex compared to trading stocks, helping you make an informed decision about which market might best suit your trading style and financial goals.

Understanding Forex and Stock Markets

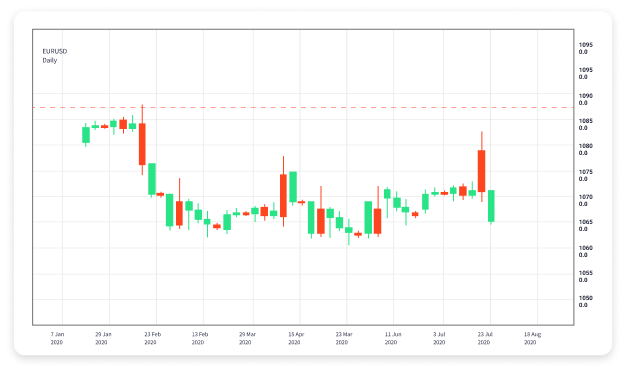

The Forex market is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. It involves the buying and selling of currencies and operates 24 hours a day, five days a week. Forex trading relies on the fluctuating values of currencies based on various economic indicators, geopolitical events, and market sentiments. Traders seek to profit from these fluctuations by speculating on currency pairs such as EUR/USD, USD/JPY, and GBP/USD.

On the other hand, stock trading involves the buying and selling of shares in publicly traded companies. The stock market has a significant presence worldwide, with major exchanges like the New York Stock Exchange (NYSE) and the Nasdaq. Stocks are traded during specific hours based on the exchange, and their values can change based on company performance, earnings reports, sector trends, and broader economic indicators.

Market Accessibility

Accessibility varies between Forex and stock markets. Forex trading is available to anyone with an internet connection and a trading account, often with lower starting capital requirements. Many Forex brokers offer leverage, allowing traders to control larger positions with a smaller amount of capital, increasing both potential returns and risks.

Stock trading also requires a brokerage account, but the competition and potential costs associated with stock trading can make it less accessible for some individuals, particularly when considering commissions and fees associated with buying and selling stocks. Additionally, while many brokers allow fractional shares, trading larger quantities of shares can require significant capital.

Market Hours

One of the most significant differences between Forex and stocks is their trading hours. The Forex market operates around the clock, which means that traders can take positions at any time, offering flexibility for those who may not be able to trade during regular business hours. This constant operation allows for immediate reaction to economic events and news releases across the globe.

Conversely, stock trading is limited by the operating hours of the respective stock exchanges. Most stock exchanges have regular trading hours, which may restrict your ability to respond quickly to market movements outside of these hours. However, after-hours trading is available on some exchanges, allowing for trading outside of normal hours, though it is subject to lower liquidity and higher volatility.

Volatility and Risk

Both Forex and stock markets present risks and opportunities for traders. Forex trading is often regarded as more volatile due to the rapid shifts in currency values driven by global economic conditions and speculation. This heightened volatility can lead to significant profit opportunities, but it also increases the likelihood of large losses.

Stock prices can also be volatile, but generally tend to be influenced by company-specific news, earnings reports, and economic forecasts. Stocks can show less abrupt movements compared to currency pairs. That said, certain sectors—such as technology or biotech—can exhibit high volatility, presenting similar risks to Forex.

Ultimately, understanding your risk tolerance and developing a proper risk management strategy is essential in both Forex and stock trading.

Liquidity

Liquidity refers to how easily an asset can be bought or sold in the market without affecting its price. The Forex market is known for its high liquidity, with major currency pairs often having tight spreads and high trading volumes. This liquidity is a compelling point for Forex traders as it allows them to enter and exit positions quickly.

In contrast, stock liquidity can vary significantly based on the company involved, its size, and its market capitalization. Blue-chip stocks generally offer high liquidity, while small-cap stocks may have lower liquidity, resulting in higher spreads and increased difficulty when attempting to enter or exit positions.

Leverage

Leverage is a double-edged sword in trading. In Forex markets, brokers often provide high leverage, allowing traders to control large positions with a relatively small amount of capital. Common leverage ratios can be anywhere from 50:1 to 100:1 or more, depending on regulation and the broker.

However, while leverage can amplify profits, it can also magnify losses, increasing risks substantially. In stock trading, leverage is typically lower and more regulated, with most brokers offering leverage ratios of 2:1 to 4:1. This lower leverage means that stock traders may have less risk of significant losses compared to their Forex counterparts but also less potential for profit on a smaller investment.

Trading Strategies

The strategies used in Forex trading often differ significantly from those in stock trading. Forex traders may employ strategies such as scalping, day trading, or swing trading, often driven by technical analysis, chart patterns, and economic news.

Stock traders may focus on fundamental analysis to determine the intrinsic value of a company based on its earnings, market position, and growth potential. They may also engage in long-term investing, holding shares over extended periods to benefit from compounding returns and dividends.

Ultimately, the choice of strategy should align with your trading style, risk tolerance, and investment horizon.

Conclusion

In conclusion, both Forex and stock trading offer unique opportunities for investors, each with its own set of challenges and rewards. Traders should evaluate their goals, risk tolerance, market understanding, and investment strategy when deciding which market to participate in. Whether you choose Forex for its liquidity and accessibility or stocks for their potential for long-term growth, a well-researched approach and a solid trading plan are essential for success in either market.