Articles

Beginning profile at the some other twigs of the identical lender acquired’t improve your insurance. Particular loan providers my response provide prolonged FDIC insurance thanks to her mate financial communities. For example, SoFi Bank brings around $step 3 million within the security by the instantly submitting deposits around the their circle away from mate banks. IntraFi Bucks Solution (ICS) and Certification from Put Account Registry Provider (CDARS) are things given because of IntraFi, which includes a system from banking companies you to give your finances around the multiple banks to ensure your’re also adequately secure. This particular service works together with checking profile, money industry accounts and you can Dvds. If you’d like to give your money around to grow your FDIC visibility, bank communities render a means to take action rather than financial institutions controlling multiple account yourself.

- While you are borrowing unions are not protected by FDIC insurance rates defenses, he or she is nevertheless safe.

- A landlord can keep their put currency for rental for individuals who gone out instead of offering best created observe.

- Make the produced club password to help you an actual location that have PayNearMe services such as Loved ones Dollars or 7-Eleven.

- A good investment regarding the finance is not covered or secured because of the the newest Federal Deposit Insurance rates Firm and other bodies agency.

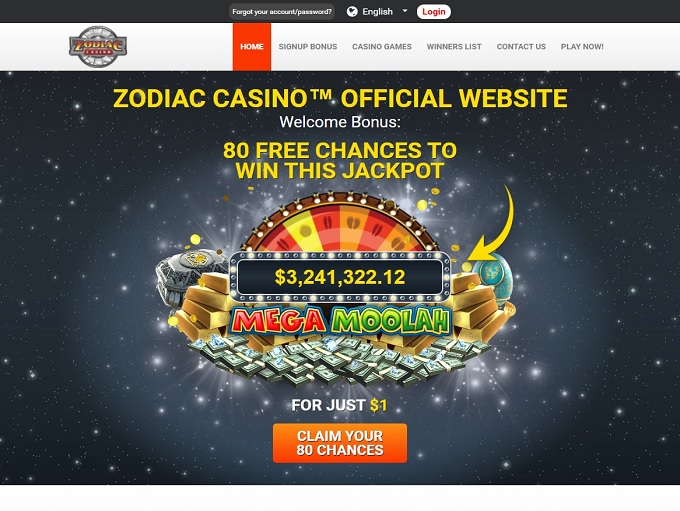

they Local casino – Best Bitcoin step 1 Buck Deposit Local casino Bonus

When you subscribe Luck Coins, the new Silver Money bundles is open to buy. The tiniest deal will cost you $5 and supply your one million Coins and you will 515 Chance Gold coins. That is a really a good purchase price and adds quite a bit from coinage for your requirements. As opposed to the other Social Gambling enterprises your’ll read about in this article, Risk.us Local casino just accepts cryptocurrency as a method away from percentage. Various kinds cryptocurrency is accepted, however, so that you’ll provides loads of choices at your disposal when you yourself have an excellent crypto purse. Share.united states Local casino provides multiple Silver Coin bundles available.

It do need some research basic to find the best financial. For example, for individuals who’re also looking for deals profile, you’d need to examine interest levels and you will fees in the some other banking institutions. On the web banking companies normally render higher APYs so you can savers minimizing fees, versus conventional stone-and-mortar banking companies. An individual will be a member of LuckyLand Harbors, you can make SCs and you will Gold coins daily from the logging inside. Include also large degrees of digital currency by the looking to find a silver Coin package.

As to the reasons Limelight Bank?

Not only can you appreciate Western european Roulette, but the majority of other types and you can differences also. There’s zero restrict on the offered bonuses at the $step one casinos as they also have free revolves on the current online game, fits bonuses that have expert terms and conditions. Also, you may also predict expert advantages out of respect programs, VIP account and more! It all depends to the $step one local casino you choose as they all appeal to some other player desires.

The brand new 2008 improve are the initial because the High Despair to help you occur in response to a serious economic emergency. Congress initial implied they so you can history only provided the brand new threat of common financial downfalls, but you to definitely wasn’t as. The newest Dodd-Honest Act out of 2010, a banking change and you can user security package passed to help you avert an excellent repeat of one’s GFC, generated the new $250,000 limit permanent. Congress didn’t should supply the newly created FDIC a blank view otherwise prompt irresponsible behavior, so it put rigid limitations to your matter protected.

Particular associations have started to provide around $step 3 million from FDIC insurance policies.

- Information from the actions to have opening a new membership.

- For reason for it part “regular fool around with or leasing” form have fun with or rental to own an expression away from not more than 125 consecutive weeks to own home-based motives by a man having a good long lasting place of household elsewhere.

- If you’re considering starting a card union account, approach it the same way you would a checking account.

- The good news is, the new FDIC went inside and you may ensured you to even when many financial staff destroyed its operate, no depositors missing one covered financing.

- The comments, put slides, and canceled checks commonly thought deposit membership info.

- Meaning comparing the newest costs you may also shell out and the desire you could secure, and also other features for example on the internet and cellular banking availability or the sized their Atm network.

Financing One to Bank is not accountable for people injuries or obligations due to the conclusion a free account dating. Susceptible to people legal rights we would provides with regards to advance observe out of withdrawal from your own membership, you can also romantic your account any time as well as one reason. If your account try overdrawn whenever we romantic they, your invest in punctually pay all number owed in order to you. The fresh FDIC contributes together the places inside retirement account in the list above owned by a similar person at the same insured lender and you may makes sure the total amount around all in all, $250,000. Beneficiaries will be called within these profile, however, that does not increase the amount of the new deposit insurance coverage exposure.

For many who withdraw of a great Cd earlier grows up, the fresh penalty is frequently equivalent to the level of desire gained throughout the a particular period of time. For instance, a lender get enforce a punishment out of 90 days of easy focus for the a-one-12 months Cd for many who withdraw away from you to definitely Computer game before the year is actually upwards. As the particular steps can differ by the Atm host and you can lender, of many pursue a similar acquisition of procedures. Let’s walk-through a few of the rules of the bucks put and check out certain factors to remember along how.

We’ve applied our very own strong 23-action remark way to 2000+ casino reviews and you can 5000+ incentive offers, making sure we identify the fresh trusted, safest platforms which have actual extra value. There are also AGCO registered and managed $step 1 minute put gambling enterprises for Ontario in the 2025 and you can our faithful web page to have Ontario has every piece of information players will demand and a listing of the major 10 Ontario gambling enterprises where you could play for just a buck. There are many reasons somebody favor a gambling establishment with a-1 dollar lowest deposit.

The retailer could possibly get request a good preauthorization on the exchange. For many who demand me to look and you may/or duplicate any information (comments, inspections, places, withdrawals, etc.) we may cost you, and you commit to spend it percentage. Should your expected commission is actually highest, you might be asked to expend the price tag ahead.

A lot more internet casino tips

Vanguard Federal Money Market Financing is a shared money that may be eligible for SIPC security. However, because they’re different kinds of things, the amount of money they provide is generally additional. For further considerations, consider the newest Innovative Lender Brush Items Terms of service (PDF). The good news is which you wear’t need risk which have uninsured places. Banking companies and you can credit unions provide numerous ways to design their membership to be sure your entire cash is safe. The brand new FDIC visibility is actually $250,one hundred thousand full for all solitary membership belonging to the same people at the same insured bank.

From the installing several beneficiaries to suit your account, you could potentially increase your FDIC visibility to $step one.twenty-five million overall. And, take the time to remark your bank account balances and also the FDIC laws and regulations you to pertain. This can be particularly important and in case there has been a huge improvement in your daily life, for example, a dying on the family members, a breakup, or a big put from your home product sales. Those situations you are going to place the your money more the new federal limit. When you create a great revocable trust membership, you usually signify the amount of money have a tendency to solution to named beneficiaries through to the dying. I’ve become your own fund blogger and you can publisher for over 20 years specializing in currency management, deposit membership, investing, fintech and cryptocurrency.