Essential Forex Trading Strategies for Beginners

If you are new to the world of Forex trading, you might feel overwhelmed by the multitude of strategies available. With countless techniques, tools, and resources, the learning curve can be steep. However, understanding some fundamental strategies can help you gain confidence and become more successful in your trading endeavors. In this article, we will discuss various Forex trading strategies that are suitable for beginners, and guide you through the essential concepts needed for effective trading. You can also explore various forex trading strategies for beginners Forex Trading Platforms to find the best fit for your trading style.

1. Understanding Forex Market Basics

Before jumping into specific strategies, it’s crucial to familiarize yourself with the basics of the Forex market. The Forex market is where currencies are traded, and it operates 24 hours a day, five days a week. The primary objective of Forex trading is to profit from fluctuations in the value of currencies.

Key concepts to understand include:

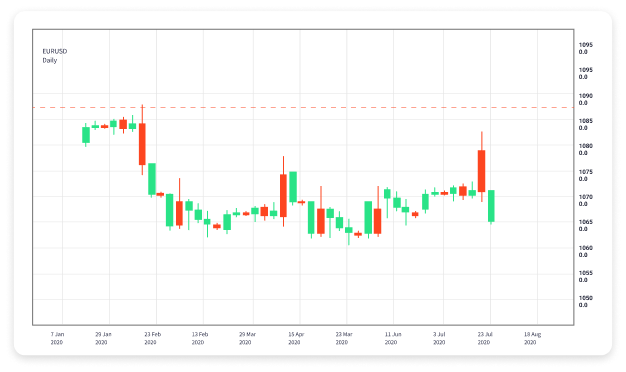

– **Currency Pairs**: Currencies are traded in pairs (e.g., EUR/USD), with the first currency being the base and the second the quote.

– **Pips**: This is the smallest price movement that a currency pair can make, often measured in fractions of a cent.

– **Leverage**: Traders can borrow capital to trade larger amounts than they possess, which can amplify both gains and losses.

Having a firm grasp of these fundamentals is essential for developing effective Forex trading strategies.

2. Technical Analysis

Technical analysis is one of the most popular methods among Forex traders because it relies on price charts and indicators to forecast future price movements. Here’s how you can get started:

– **Candlestick Patterns**: Learning how to read candlestick patterns can provide insights into market sentiment. Patterns like doji, engulfing, and hammers can signal potential reversals and continuations.

– **Moving Averages**: A moving average smooths out price data to identify trends. Beginners often use simple moving averages (SMA) to determine entry and exit points based on crossovers.

– **Support and Resistance Levels**: Identify key price levels where the market has shown strong buying (support) or selling (resistance) in the past. These levels can often act as triggers for trading decisions.

Combining these indicators and patterns can help you make informed trading decisions.

3. Fundamental Analysis

While technical analysis focuses on price movements, fundamental analysis looks at economic indicators that can influence currency values. Key elements include:

– **Economic Reports**: Reports like GDP, unemployment rates, and inflation data provide insights into a country’s economic health, which can affect its currency.

– **News Releases**: Major news events (e.g., central bank announcements, geopolitical issues) can lead to significant price movements. Staying abreast of such news can help inform your trading strategy.

Beginners can benefit from maintaining an economic calendar to anticipate important events that may impact the market.

4. Swing Trading

Swing trading is a medium-term strategy where traders capitalize on price « swings » over days or weeks. This approach is ideal for beginners as it requires less time monitoring the market compared to day trading. Key points include:

– **Entry and Exit Points**: Use technical analysis to establish potential entry and exit points. Swing traders often look for price reversals near support or resistance levels.

– **Risk Management**: Implement stop-loss orders to limit potential losses and protect your trading capital.

– **Patience**: Swing trading requires patience, as positions may take time to develop. Resist the urge to force trades and stick to your strategy.

5. Trend Following

Trend following is a popular strategy that involves trading in the direction of the market trend. Recognizing and riding trends can lead to profitable trades. Here are some tips:

– **Identify Trends**: Use trend lines or moving averages to identify whether the market is in an uptrend, downtrend, or sideways.

– **Trade with the Trend**: Enter trades that align with the current trend, rather than going against it. This increases the probability of successful trades.

– **Stay Disciplined**: Trends can last for extended periods, so stick to your plan and don’t exit early unless the trend shows signs of reversal.

6. Risk Management Strategies

No trading strategy is complete without an effective risk management plan. Protecting your capital is essential for long-term success in Forex trading. Consider the following:

– **Set a Risk-to-Reward Ratio**: Aim for a risk-to-reward ratio of at least 1:2, meaning for every dollar risked, the potential gain should be at least two dollars.

– **Use Stop-Loss Orders**: These orders automatically sell your position once a specific loss threshold is reached, helping to minimize losses.

– **Limit Leverage**: While leverage can amplify profits, it can also magnify losses. Beginners should be cautious with leverage and consider trading with lower levels until they gain more experience.

7. Developing Your Trading Plan

A well-defined trading plan is vital for systematic and disciplined trading. Your plan should include elements such as:

– **Trading Goals**: Set clear, achievable goals based on your risk tolerance and available capital.

– **Trade Entry and Exit Rules**: Outline the criteria you will use for entering and exiting trades backed by your analysis and strategies.

– **Review and Adjust**: Regularly review your trades (win/loss ratio, learned lessons) to adapt and refine your strategy over time.

8. Leveraging Technology

Advancements in technology make Forex trading more accessible than ever. Consider utilizing:

– **Trading Platforms**: Utilize reliable Forex trading platforms that provide user-friendly interfaces, advanced charting tools, and automation capabilities.

– **Mobile Trading**: Many platforms offer mobile apps that allow you to trade on the go, enabling you to seize opportunities no matter where you are.

– **Demo Accounts**: Before committing real money, practice on demo accounts to familiarize yourself with the trading environment and test your strategies without financial risk.

Conclusion

Forex trading can be a rewarding yet challenging venture. By understanding the basics, employing effective strategies, and incorporating sound risk management, beginners can navigate the Forex markets with greater confidence. Remember, successful trading is not about winning every trade; it’s about sticking to a well-thought-out plan and consistently applying learned strategies. Whether you choose to trade short-term or long-term, focus on continuous learning and stay updated with market trends, and you’ll be well on your way to becoming a successful Forex trader.