Content

Both possibilities has produced instant, pain-100 percent free places and you may easy detachment experience one to get a few away from days to techniques. We feel bet365 is in the best tier in terms in order to quickest payout sportsbooks. Of several Android profiles provides noticed that the new app might use a renew to really make it simpler to navigate particular places, along with effective-margin wagers and you will solution traces. Bet365 are a reliable sportsbook which was giving bets while the 2001.

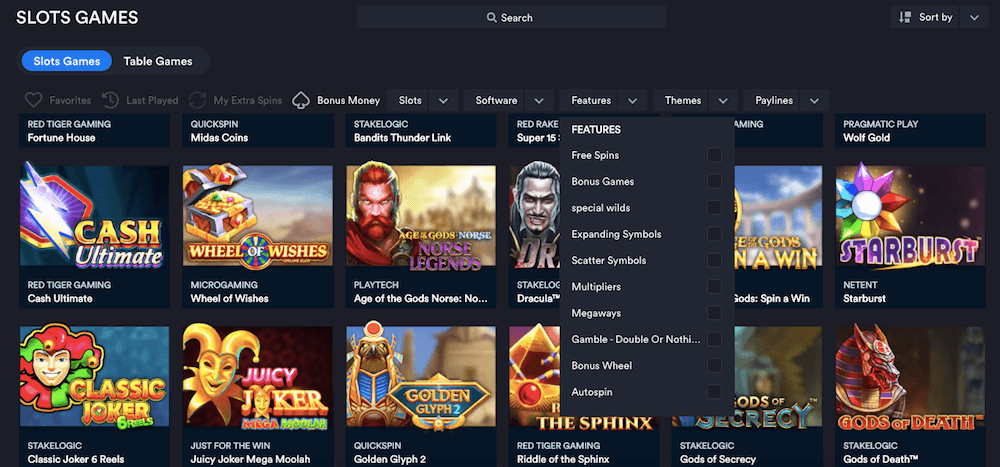

Casinos with instant payout – ten Real-estate management functions

We’ve noticed that it always is beneficial shop around from the some other sportsbooks for the best chance. For the of a lot days, bet365 get favorable odds-on a specific industry. Yet not, there are many times when your’ll come across a better rates someplace else. The newest twin invited offer is actually bet365’s bread-and-butter, but the website comes with the of several ongoing promotions throughout every season for existing customers. The fresh app provides a nice-looking build you to simplifies routing, letting you place a wager easily.

Before you focus: sign up for permission to focus

A good PSP facilitate give payroll and you will payroll-relevant income tax requirements on the part of the brand new employer. An excellent PSP will get ready yourself paychecks for group, prepare yourself and you may document employment taxation statements, prepare Versions W-2, and make government income tax places or other government taxation costs. A good PSP actually liable while the sometimes a manager or an agent of one’s company to your boss’s a career taxes. If a manager is using a great PSP to do its tax commitments, the fresh boss remains accountable for its work income tax personal debt, and accountability to own employment fees. If you withhold otherwise have to withhold federal income tax (in addition to content withholding) away from nonpayroll repayments, you need to document Form 945. All the federal income tax withholding out of nonpayroll money which is stated to the Forms 1099 otherwise Form W-2G have to be integrated to the Form 945, and not on the other function for example Setting 1040-Parece, Projected Income tax for people.

Estate and you will gift taxes

Preparing from execution requires an alerts to your Court with right jurisdiction with regards to the circumstances. Because the Judge provides so it observe, it does notify the fresh events, bringing a nine-day name to file a quick of allegations and you will complete all of the the evidence they have, so the Judge can pick whether the foreign choice can also be become carried out inside the Mexico or perhaps not. During this process, the fresh Courtroom is only going to take a look at if this choice can be carried out inside the Mexico, because the determination casinos with instant payout contained is res iudicata. Very first, the evidence have to be related to your instance, and also the people ought to provide objections in order to justify it. Even better, the evidence should be offered with regards to the relevant legislation, since the all of the evidence try managed from the kind of regulations; thus, if the research is not submitted with regards to the laws, it could be dismissed. With regards to the kind of proceeding (civil/commercial, written/oral), the law establishes the newest deadline in this that your statement from protection should be recorded.

Let’s say We Wear’t Have to File a tax Go back?

The brand new workplace events features a primary character to play inside getting procedures to prevent performs-relevant wounds and you will conditions. In which conformity can not be attained, prosecution (whenever Amp hasn’t been utilized) can be initiated in order to deter coming non-conformity. The introduction of Area IV of one’s Canada Work Password and you may Amplifier Laws will bring an additional device to get conformity that have Part II of your Password and its own legislation.

Have the independency you will want to customize the offers and take benefit of protected production. The pace try secured to the full-length of any kind of label you select. It does let you secure $200 within the incentive bets simply by position a good $5 football bet together with your very first bet. You should buy $200 inside added bonus wagers after you put a great $5 activities bet otherwise get a first Bet Back-up value as much as $step one,one hundred thousand with the bet365 added bonus password. The utmost profits inside a great twenty four-hr months at the bet365 try $1 million, regardless of your share. Keep in mind that bet365 supplies the authority to cover bettors’ playing limits during the their discernment.

The newest give and you may bond address much time-condition and ongoing demands identified by people having disabilities, their loved ones, and you will organizations help them to remove barriers to help you protecting to your future. The brand new Canada Impairment Savings Offer are a finite complimentary grant up in order to $step 3,five-hundred annually your government dumps to your an excellent RDSP to suits contributions on the bundle. Gives could be paid to your an idea through to the prevent out of the fresh twelve months where the beneficiary turns forty two yrs . old. Concurrently, the us government usually deposit an excellent Canada Impairment Offers Thread of up in order to $step one,000 a year for the RDSPs out of low and more compact-income Canadians. There isn’t any annual RDSP share limit, but there is however a max existence sum limitation from $200,one hundred thousand.

When you yourself have cutting-edge banking demands, such as finance, credit cards, insurance rates otherwise a corporate membership, a conventional savings account is a much better fit. Dollars App is the greatest if the monetary demands revolve to your swinging currency up to ranging from friends and family. A cash for Organization account provides you with endless each day transfers, when you are your own account limits her or him, to accommodate the better volume of deals you’lso are likely to have because the a corporate. Cash to own Company profile enable you to receive costs away from users using borrowing from the bank otherwise debit cards by the delivering him or her a payment hook up. To simply accept stock, you must have or open an agent membership from the software.

Inner characteristics are only those things and you can info one use round the an organisation rather than to people given specifically in order to an application. The brand new quantity found in the qualification have to concur with the number away from federal income tax withheld and you will said to your every quarter federal income tax go back(s) of your own agency (Function 941). Generally, you could potentially take a card up against the FUTA taxation to own number your paid off on the county unemployment finance. For individuals who’re eligible to the utmost 5.4% credit, the new FUTA taxation speed immediately after credit is 0.6%. You’lso are eligible to the utmost credit for many who repaid a state unemployment fees completely, timely, as well as on all the same earnings as the is actually susceptible to FUTA tax, and also as long while the county isn’t determined to be a good borrowing reduction condition. The brand new Government Jobless Income tax Act (FUTA), having condition unemployment options, provides for repayments of unemployment payment to pros who’ve lost its operate.

After per taxation 12 months, the fresh tax workplace turns out whether you’ve got paid back a correct count and generally things a good discount, but you can setup a declare yourself if you think you have overpaid. « Even after starting a joint membership, it’s still vital that you have your very own independent membership so that you may have financial independence when needed. » « Not all the lovers realize which, making it good for discuss your credit rating together with your companion, understand the effects away from revealing an account and determine in the event the combined economic things will work for you both, » she claims. Bakery chain Greggs enhanced its cost out of Thursday since it grappled with more work will cost you. Web sites such as Zoopla and you will Rightmove have some historical sale and you can checklist research which could assist establish if the possessions you happen to be to purchase have battled to market otherwise become sold multiple times inside the current ages.

Filling out Their Income tax Go back

- If your alter from the new Internal revenue service lead to a reimbursement owed, you need to document a declare to possess refund in this 2 yrs.

- There aren’t any laws of funding litigation, contingency and you can conditional percentage preparations.

- After the condition’s cancellation go out no the brand new or active allege repayments might possibly be made.

- These types of decisions triggered another common motif during the these establishments – heightened contact with focus-rates chance, and this lay inactive as the unrealized losses for the majority of financial institutions because the rates rapidly flower over the past seasons.

- The new inspector standard urged the brand new Virtual assistant to determine whether to remain otherwise cancel your panels.

You do not have making projected tax payments if you is actually a good nonresident or the fresh resident out of California inside 2024 and you will didn’t have a california tax responsibility inside 2023. Should your man are partnered/otherwise a keen RDP, you really must be permitted claim a depending different borrowing from the bank to own the child. If the there are differences when considering the federal and you will California income, age.g., societal shelter advantages, complete Agenda Ca (540). Get into on the internet 14 the total amount from Plan Ca (540), Part I, range 27, line B. When the a negative matter, discover Schedule Ca (540), Region I, range 27 recommendations. If your dependent kid was given birth to and you may passed away inside the 2023 and you don’t have an SSN or a keen ITIN to your kid, generate “Died” on the room delivered to the brand new SSN and include a duplicate of one’s boy’s beginning certification, passing certification, or healthcare details.

Power from Attorneys – When the someone waiting the taxation get back, he is not immediately granted usage of your own taxation information in the future transactions around. At some point, you could need to specify people to operate for you inside the matters relevant otherwise unrelated to that income tax go back (e.g., an audit test). To guard the confidentiality, you should submit to us an appropriate file entitled a good “Power out of Attorney” (POA) authorizing another person to go over otherwise receive personal data regarding the income tax facts.

For individuals who and/or your wife/RDP is 65 years old otherwise older as of January step one, 2024, and you will claim the new Older Exemption Borrowing, you possibly can make a blended overall share as high as $288 or $144 for each and every mate/RDP. Benefits built to which money would be distributed to the area Service to the Aging Councils out of Ca (TACC) to add advice on and you will support from Seniors issues. Any a lot of efforts not needed because of the TACC might possibly be distributed to senior citizen solution communities during the California to possess meals, adult daycare, and you can transportation. Do not mount one data files on the taxation go back except if specifically educated.