Think a warrior’s helmet; the new inverse head and you may shoulders development shows the brand new resilience from consumers, establishing the newest changeover from a great downtrend so you can a keen uptrend. That it bullish reversal trend is characterized by a main trough, the head, flanked from the a few shallower troughs, the fresh arms, signifying a great weakening offer-from and you may a possible bullish rise. The brand new trend are at achievement since the rate ascends through the neckline, prompting investors to carry on a lot of time ranks to the anticipate away from a rally. With volume or other technology indicators as the allies, traders is also wield which development on the virtue, so it is perhaps one of the most credible reversal habits on the market. The newest bearish rectangle trend is a pattern reversal development you to signals a potential downwards breakout.

Platforma pkn orlen – Simple tips to Change Diamond Better?

Traders acquire more exact predictions and improve their entries and exits by the merging Fibonacci retracements with established designs. This type of retracement profile act as a guide, verifying graph designs such triangles, avenues, and you may head and you may arms by the reflecting key areas to possess rate reversals otherwise continuations. The significance of graph patterns to possess investors and you can investors is really because it submit predictive expertise one to guide choice-and make and you will exchange approach design. Traders anticipate rates actions from the looking at such patterns, which will help them determine if an industry goes on in latest advice or reverses. The newest predictive ability is a key element of graph patterns inside technology research, offering worthwhile foresight inside trading decisions.

Ideas on how to Change Mentioned Progress?

Bullish rectangle models try extension habits you to form throughout the an enthusiastic uptrend while the price consolidates anywhere between horizontal service and resistance account. Channel models represent periods out of consistent speed direction within this a range, getting investors with chances to trading ranging from assistance and resistance membership. The brand new breakout above the resistance height designed from the highs anywhere between the fresh troughs confirms the new trend reverse, have a tendency to with increased regularity. Rounding passes are long-label reverse chart patterns you to definitely be like a « U » figure. The head and you will shoulders trend are a bearish reverse development one signals a shift from an uptrend to help you a good downtrend.

Assistance contours are seen as the a floor and therefore are rate zones one a monetary resource discovers tough to penetrate less than. Service traces are drawn because of the hooking up prior lows where prices can be both avoid and you will reverse otherwise use if the market is in the a great downtrend. You need to know that the contrary pattern of the golden get across ‘s the demise mix.

A double bottom pattern is actually a bullish reverse trend resembling the newest page « W. » They models if the speed hits an assist level twice, which have an average pullback in between. A map pattern is a definite development to your a stock chart that create a trading laws otherwise a sign of coming price movements. It’s including a great roadmap that helps you are aware in which an inventory would be oriented according to its past actions. As well as the very first graph habits, there are even heightened chart models you to people are able to use to make advised trade choices.

They versions after a robust downtrend in the event the speed balances and gradually recovers. It change pattern reflects poor platforma pkn orlen to find interest and you will indicators that the prevalent downtrend will remain. Such graph development indicators your prevailing trend has a tendency to reverse pursuing the third drive. Megaphone designs, known as expanding formations, try described as broadening rates volatility, developing a form the spot where the trendlines diverge external. It exchange pattern typically appears from the top out of an enthusiastic uptrend and you can shows that the fresh trend try losing momentum, with suppliers starting to control.

Multiple tops provides an excellent 70% rate of success in the appearing trend reversals, centered on Davis’s 2023 study, “Reversal Models inside the Bull Segments,” used by Institute away from Technical Research. A study held by Thomas Bulkowski in the 2008 analyzed the new efficiency from twice finest habits from the stock exchange. His search showed that the brand new double finest development had an endurance rates from 73%.

Double Bottom

That is, simply because a great pennant graph trend appears to be forming doesn’t suggest it always have a tendency to. Instead, a keen inverse lead and you may arms ‘s the reverse and will indicate an optimistic trend in the event the opposition range (or neckline) are entered of less than. Shaped triangle models are like ascending and you may descending triangles, but with one-line sloping down plus one line sloping upwards during the about very same position. Such, straight times of red or black (i.e., the fresh stock signed below they open to own several months within the a row) you are going to suggest a bearish sentiment.

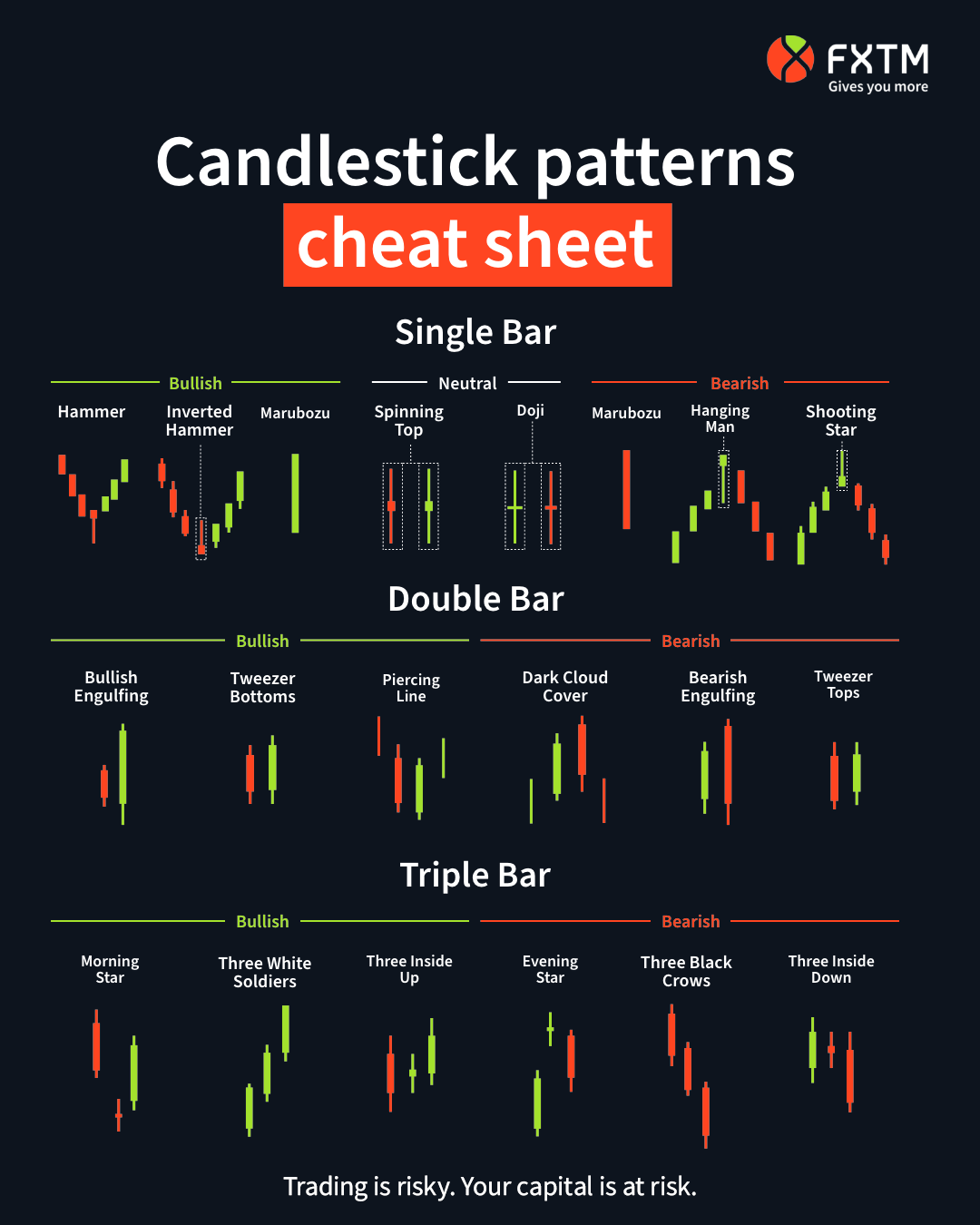

The newest optimistic reverse is actually verified when the rates holidays over the resistance height, usually resulting in a strong up speed path. Chart designs render expertise for the future guidance out of cost by the pinpointing field manner and you can potential motions more than long stretches. The fresh models help buyers and you may buyers select regarding the pattern continuation otherwise reverse. Candlestick patterns give precise indicators to own time and entryway prices, making them good for small-identity actions and you may quick market responses. Traders boost their decision-making and you will boost trade delivery by the merging chart patterns to own directional study and you will candlestick habits to own admission optimisation.

The fresh stock have to crack resistance intraday and have romantic the fresh club above you to level. Place the stop loss below the fresh candlestick pattern one affirmed the fresh exchange admission. The newest stop loss placement aligns for the field construction laid out from the the fresh graph development, balancing protection with room to the trade to grow.

The new trend applies to brings, fx, and futures segments inside the good fashion. It has a medium to highest success rate whenever technology signs such as help account and you can moving averages establish it. The newest Inactive Cat Jump Patterns try bearish chart patterns one to laws a short-term healing inside the a downtrend prior to costs restart shedding. Inactive Pet Jump Patterns are available after a significant decline, in which a short-lived rate rally misleads investors to the considering a jump is occurring. The brand new pattern is a result of brief coating or speculative to purchase but fails to help you experience energy.

You might see extended-label support out of people previous higher regularity bars from previous large volume days. Talking about have a tendency to footprints away from larger status proprietors which could possibly get decide to help with its position right here. I mention so it inside the a recent podcast occurrence to your Simcast out of VWAP boulevard. Targets might be set from the downs of your own framework, or by the computing the fresh wide the main triangle and you can applying they to the breakout area. Since the stock reaches their top and you can offering did its job, come across a dysfunction entry thanks to a code range or all the way down development line. Per pattern will show you, if you look intently adequate, the path out of least opposition on the horizon.