Posts

The quickest look at deposit method depends on the bank, however, a cellular look at put takes to 1 day lengthened so you can process than an out in-person or Automatic teller machine put. To find out how long view dumps bring, find your financial’s rules to the handling timelines and you will daily slashed-away from times for each type of consider put. Discover financial institutions for the best cellular deposit features because of the evaluating Bankrate’s finest checking membership one offe electronic financial potential. Cellular put is amongst the ways in which financial is definitely growing.

This may interest of a lot punters who are not safe from the discussing research useful reference online. Since the payments will be added to the newest bull, you don’t have to offer out a bank checking account or a card credit count on the gambling enterprise or 3rd party. Rather the asking will be out of the way by punter for the company later on because of a safe means you select. Handling minutes for mobile deposits are usually one or two organization months, however, items including put cutoff minutes, vacations and getaways can impact accessibility. Places made following lender’s cutoff go out – have a tendency to later afternoon – is generally processed the next working day.

Zero, you will not be able to generate distributions having fun with shell out on the mobile harbors. Very, make sure to features an alternative commission opportinity for cashing away your gains in the gaming web site. You can link your eligible examining or savings account to an enthusiastic account you’ve got in the other bank. If you are mobile deposits try safer, there’s constantly the possibility of people trying to deposit a twice—once from the cellular telephone and you can once more personally. Extremely banks place daily otherwise monthly caps about how precisely much your can also be deposit from the software.

Eligible Funding One profiles have access to mobile look at deposit right from the Investment One Cellular app. Cellular view put works by using an assistance entitled secluded deposit take. Essentially, secluded put get allows you to take an electronic digital image of your own consider. Debt business will likely then gather the pictures and you may process your deposit. Once you build a cellular consider deposit, you could potentially’t cancel handling. If you’ve made duplicate places, we’re going to connect the newest mistake and you may inform you.

How can i bring an excellent image of the fresh consider?

Zero, you do not pay a fee once you generate a deposit on the your own Money You to definitely user examining otherwise checking account. If your mobile phone or tablet is actually dated, should your app bugs, or if your web union are erratic, you might run into points. A detrimental digital camera, a buggy application, and you may a poor code can be all the stop you from depositing checks if you don’t resolve the problem. Citibank.com provides details about and you can access to accounts and you will economic functions provided by Citibank, N.A good. It doesn’t, and cannot getting construed as the, a deal, invitation or solicitation away from functions to people outside of the Joined States. Open another SoFi Examining and you can Savings account by 9/3/twenty five, install qualified head deposit inside two months, and keep maintaining head put to possess six months.Terms apply.

For the reason that enjoy, you’ll see a notification telling you if the financing have a tendency to be around and you can giving you a choice of canceling the new deposit. Just how long before you can accessibility your deposited Wells Fargo money depends on the type of put and if Wells Fargo towns a hold on the money. Monitors of a value more $5,100000 are believed ‘large checks’, and the means of cashing her or him try a bit other. If you want to bucks a which is over $5,one hundred thousand, you’ll be able to always need to see a financial and you will have to attend a bit to truly get your currency. If your membership are overdrawn, you might not be able to deposit a with the mobile app.

If the membership are suspended, you would not manage to deposit a using the cellular app. Make an effort to speak to your lender to respond to the issue prior to making a deposit. Really banks do not deal with changed or broken checks for mobile deposit. You will need to get hold of your lender to have advice on how in order to deposit a inside position.

Of several programs allow you to create associate jobs and you may permissions if the multiple anyone manage deposits to suit your needs. That it contributes other safeguard by allowing merely subscribed associates so you can deposit checks. Terminology, standards and you will charges for membership, points, programs and you can characteristics is actually at the mercy of alter. Only a few account, points, and you may features in addition to cost explained here are obtainable in all the jurisdictions or to all users. Their qualification to own a specific tool and you will services is susceptible to a last dedication by Citibank.

Mobile financial is actually an excellent subset out of electronic financial, it comes strictly for the cell phone-founded experience a bank provides. All the cellular banks is actually kind of electronic financial institutions, but not all the digital banks try cellular-concentrated. Within our even more on the internet and cellular world, a lot of people want to capture their banking on the run. Handling one of the better cellular banking companies can make it an easy task to control your money from anyplace, spending bills and you will mobile financing effortlessly. TheCreditReview.com try an online financing that provide rewarding posts and you will analysis have in order to folks.

Get clear photographs of your check with your mobile device

The sorts of checks you are able to add to your account playing with cellular take a look at deposit are private checks, company monitors, cashier’s checks and you may bodies-granted inspections. This includes taxation refunds and you can stimuli checks, like those provided by the new CARES Operate. A lot more financial institutions and you will credit unions are offering cellular take a look at deposit because the a convenient method for users to provide money to their account. The best cellular financial apps ensure it is an easy task to fit everything in you ought to from your cellular telephone. You can put checks, transfer finance ranging from account, pay bills, posting money in order to members of the family, as well as discover a new membership together with your cellular phone.

Find out how to add a merchant account from various other financial so you can their Money You to membership. The message on this page is for general guidance and training motives merely and should not be construed as the court or tax information. Stripe does not guarantee or ensure the accurateness, completeness, adequacy, or currency of your information in the blog post. You will want to check with a simple yet effective attorneys otherwise accountant registered to train on your own jurisdiction for advice on your specific condition. Encourage your self on the education and you will devices in order to accept the long term away from banking—right from the brand new hand of your own give.

To suit your security, keep up with the brand new search for at the least five days Once getting confirmation which might have been recognized. Once you’lso are happy to dispose of it, mark they “VOID” and throw away they in a fashion that suppress it away from becoming exhibited to own percentage once again. If difficulty would be to develop as well as the brand new consider isn’t any expanded offered, excite get in touch with the brand new issuer of one’s look at discover an alternative duplicate which can be resubmitted to own deposit. Be certain that you’re playing with a proper software from your own monetary institution to help you deposit a great cheque electronically.

When you are the blogs cover anything from or ability find enterprises, suppliers, and things, our approach to compiling such are fair and you may objective. The message that individuals manage is free and on their own-acquired, without people repaid-to own venture. « Pursue Personal Client » is the brand name to possess a financial and you may funding device and you will solution providing, requiring a Pursue Individual Client Examining℠ membership. If the a is provided for you and something people, like your mate, the lender might need you to couple sign the fresh take a look at before you put it. If it’s granted for you or your wife, you might typically deposit the newest look at oneself.

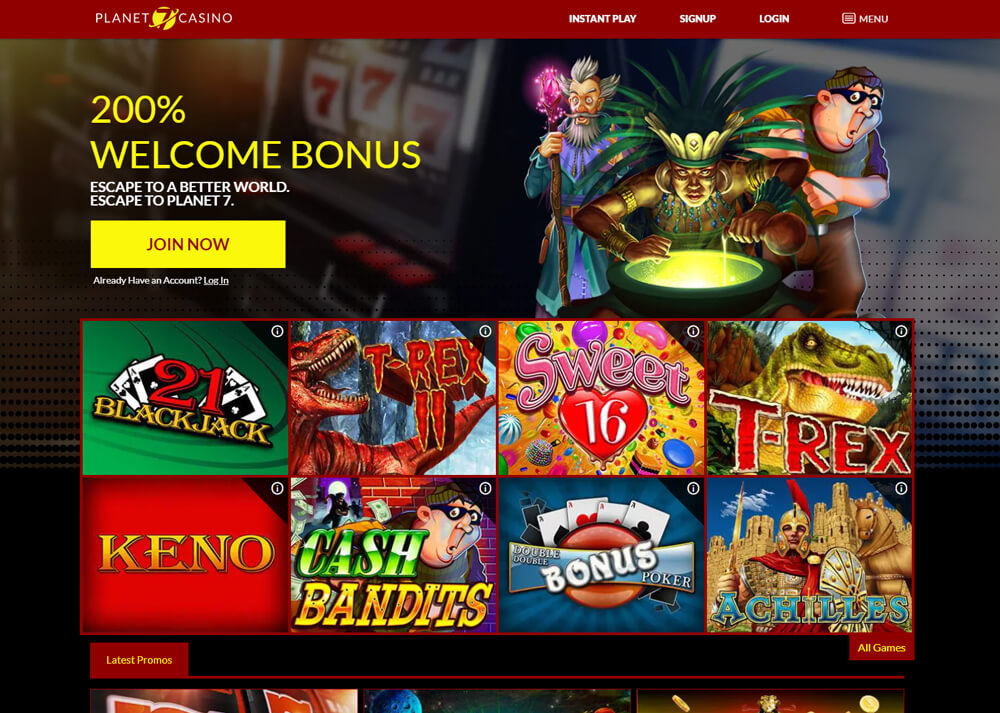

Mobile deposit is actually much easier if you need to deposit a check immediately after business hours, on the a lender getaway, or over a week-end. Once you test and you may publish the new photographs of your take a look at and you may fill out their deposit consult, everything is actually encoded and sent to your financial. The new look at then follows the quality tips for processing and you can cleaning so the fund can be deposit into the membership. Cellular view put work having fun with remote put bring technology. When you take a photo of your own take a look at, it’s the same as checking an image otherwise document to make a digital duplicate on your computer. Credit card casinos are being introduced for hours on end because of the interest in it debit cards wor…